Practical Ways to Minimize Exposure to Crypto Market Volatility

In this exclusive guide, we’re going to delve into the complexities of cryptocurrency volatility, how it affects online gambling, and suggest some useful strategies for managing these risks effectively.

Specifically, we’ll look at things like the importance of diversification, setting loss limits, effective bankroll management, getting timing right, factoring in transaction speeds, hedging strategies, and using stablecoins.

Understanding Cryptocurrency Volatility in Gambling

Yep, as you’ve probably noticed, here at CoinBets, we love crypto gambling – but, we appreciate cryptocurrency can be extremely volatile. For example, it’s not unusual for the price of Bitcoin to drop by several thousand dollars in the space of a few hours.

So, it’s essential to be aware of the market and employ strategies to mitigate risk.

What is Cryptocurrency Volatility?

Cryptocurrency volatility is the degree of variation in the price of digital assets over a set period.

This can be measured using metrics including standard deviation, beta coefficient, and the average true range (ATR). The bigger the price swings, the higher the volatility, while more stability equals lower volatility.

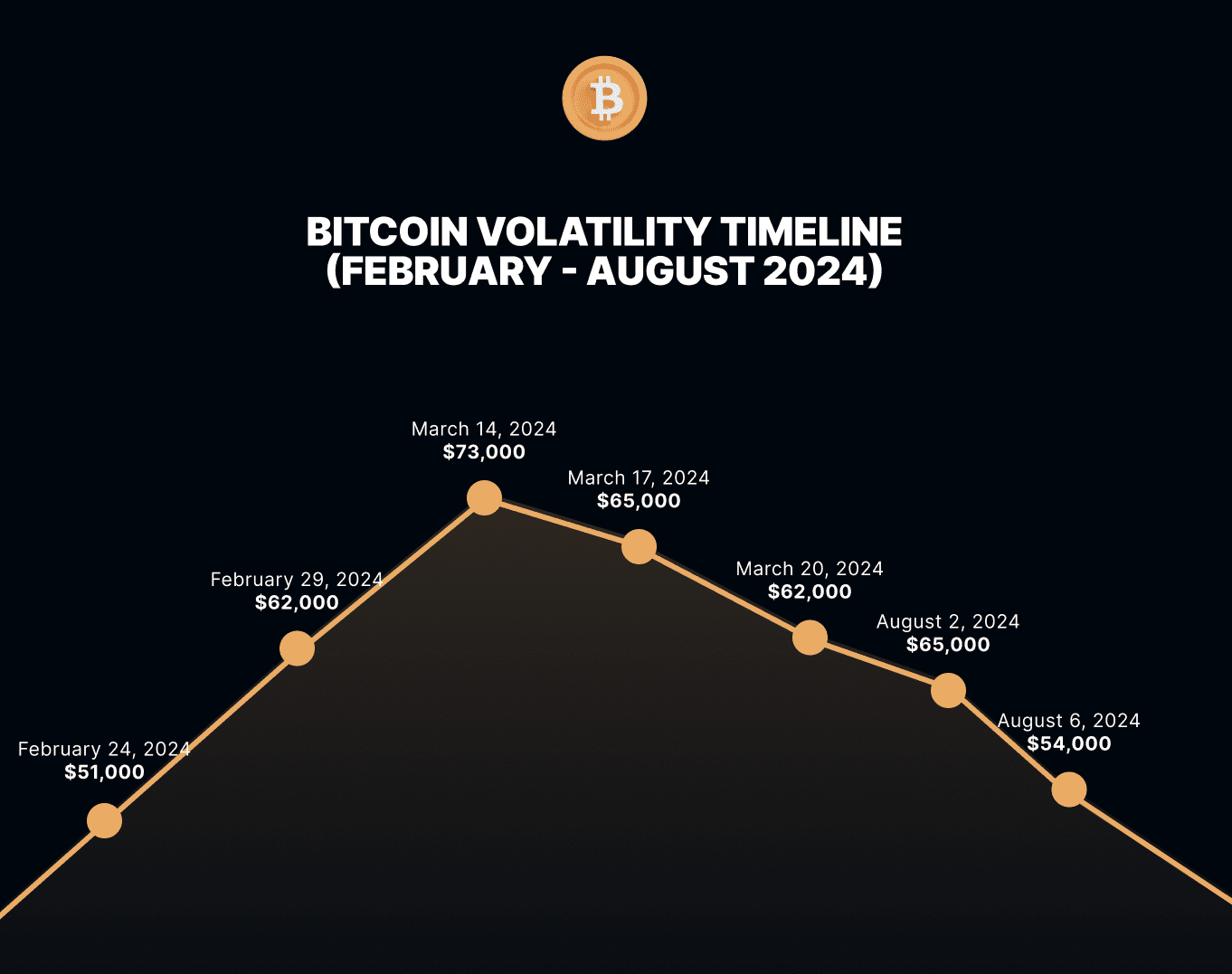

To illustrate just how volatile even the biggest cryptocurrency can be, let’s look at some of Bitcoin’s recent price fluctuations (prices provided by CoinGecko):

- On February 24, 2024, BTC was trading at just under $51,000, but by February 29 had surpassed $62,000.

- On March 14, 2024, BTC broke past $73,000, but by March 17 was approaching $65,000 and by March 20 had fallen almost to $62,000.

- On August 2, 2024, BTC was priced at just over $65,000 but had dropped to under $54,000 by August 6.

Even on a smaller time scale, the price of BTC can fluctuate significantly. For example in the 24 hours from midday on August 26 to midday on August 27, 2024, the BTC price bounced around between $63,999.53 and $62,616.90 – a difference of $1,382.63. The price differential from minute to minute often being hundreds of dollars.

This volatility can directly impact the value of deposits, winnings, and withdrawals at online casinos and sportsbooks – resulting in unexpected losses or gains. This is especially important for gamblers dealing with tight margins and high stakes.

Fortunately, by being aware of this, you can employ strategies to decrease your chances of any unexpected losses and increase your chances of making additional gains.

Why is Crypto so Volatile?

Although all currencies constantly fluctuate in value, cryptocurrencies tend to see much more dramatic price swings than major fiat currencies. But why? Well, there are several reasons, and some affect certain cryptos more than others.

1. Cryptos are Traded 24/7

Unlike traditional financial markets, cryptos are traded 24/7, 365 days per year. So, if an investor needs to liquidate assets quickly, cryptos are often the best choice. This means crypto prices can react extremely quickly to world events.

2. Whales and Retail

Whereas traditional markets, including stocks, bonds, and all kinds of derivatives, are dominated by institutional investors, the crypto space still has a lot of individual retail investors and a relatively small number of whales (individuals owning a large amount of crypto).

Retail investors tend to react to events emotionally, which is always unpredictable. Meanwhile, trades by individual whales can often be enough to move prices significantly- especially for cryptos with smaller market caps.

3. Regulatory Uncertainty

Uncertainty is no friend of stability. The constant flip-flopping and contradictory statements from regulators and politicians can easily spook markets. Lengthy legal action against specific projects is also destabilizing for the crypto space. The US Securities and Exchange Commission (SEC) lawsuit against Ripple illustrates this perfectly.

4. Rapid Technological Change

Things like blockchain forks and protocol changes can cause uncertainty. Usually, when this happens, one of the forked cryptos will see its price fall. Look at what happened with Bitcoin, and the Bitcoin Cash and Bitcoin Gold forks.

5. Security Breaches

While major blockchains like Bitcoin and Ethereum have excellent security track records, smaller blockchains and cryptos can suffer security failures, leading to a loss of confidence and panic selling.

Malicious attacks on centralized cryptocurrency exchanges, like the hacks that hit the Mt. Gox exchange in 2011-2013, can also send shockwaves through the crypto world.

6. Systematic Contagion

Some cryptocurrencies, particularly those that are part of complex DeFi ecosystems, can be vulnerable to systematic collapse. The often convoluted and opaque nature of large crypto businesses also means that, if one collapses, it can very quickly destabilize the entire crypto ecosystem. This happened with dramatic effect when the crypto exchange FTX collapsed in 2022.

7. Memecoin Manipulation

Minor altcoins, particularly those known as ‘memecoins‘, are often subject to ‘pump and dump‘ schemes. This results in a dramatic price rise followed by an instant crash. Check out this WhiteBIT article for a detailed explanation of crypto pump-and-dump schemes.

Details

Crypto Volatility Drivers

Crypto markets never close, reacting instantly to global news and events.

Large trades and emotional retail behavior cause unpredictable price swings.

Unclear or changing laws create hesitation and instability in the market.

Forks, bugs, and protocol upgrades can trigger major shifts in valuation.

Hacks or exploits shake trust and often lead to rapid sell-offs.

The collapse of one project can cascade across the entire ecosystem.

Hype-driven coins often spike and crash, amplifying market volatility.

Impacts on Gambling

This volatility adds an extra layer of complexity that crypto gamblers need to factor into their strategies. If gambling with fiat currencies is like playing regular chess, gambling with cryptocurrencies is like playing 5D chess.

Specific ways crypto volatility affects gambling:

- Value of Deposits and Winnings.

The value of crypto deposits can fluctuate significantly between when they are made and when bets are placed. In the same vein, the value of winnings can change between when they happen and when you withdraw them. This has major implications for profitability. - Withdrawal Strategies.

In regular online gambling, the only things you need to consider when withdrawing are any limits, fees, and convenience. However, when it comes to crypto withdrawals, you also need to factor in potential market movements. - Betting Experience.

This high volatility and the uncertainty it creates can add a lot of extra pressure and stress. It’s important to keep things in context and work to a plan to avoid the temptation to make impulsive decisions.

Risk Management Techniques

Okay, so now let’s discuss some specific strategies you can employ to protect your winnings, maximize your spending power, and reduce anxiety and stress.

Diversification

There are good reasons ‘diversification‘ is one of the most used buzzwords in the entire crypto space. Simply put, there are so many variables at play, that it’s impossible to foresee every eventuality. So, the most logical solution is to minimize your exposure to any single asset.

In practice, a well-diversified crypto portfolio could look something like this: 50% in high-cap coins like BTC and ETH, 35% in smaller altcoins like SOL and ADA, and 15% in memecoins like PEPE and SHIB.

Of course, there’s no right or wrong ratio and mix – you might even include assets like NFTs – but the important thing is not to “put all your eggs in one basket.”

Additionally, when it comes to crypto gambling, it can be a good idea to diversify your betting across multiple platforms. This could allow you to bet with a bigger range of cryptocurrencies, and also exploit favorable odds and promotions across different sites.

Setting Loss Limits

Many crypto casinos provide easy-to-use responsible gambling tools. Usually these allow you to set specific loss limits – you can normally find them under your account profile menu.

- Determining Loss Limits. Assess your total crypto holdings, and set a percentage- based loss limit. It should represent an amount that you can afford to lose, for example, 25% of your initial deposit.

- Sticking to Your Limits. Always stick to your limits and avoid making emotional decisions. Most importantly of all, never chase losses.

Bankroll Management

Good bankroll management is important for all gambling, but it is even more critical when it comes to crypto gambling. You should always be aware of the current value of your account balance in the context of the current crypto market. Here are some useful strategies you can follow:

- Allocate Specific Funds. Only ever gamble with a designated portion of your total crypto investment portfolio. Ring fence it and class it as a separate entity. If you lose the allocation, resist the temptation to raid your main portfolio for more.

- Actively manage Stake Sizes. Consider adjusting your stake sizes to suit the cryptocurrency market conditions. For example, when things are particularly volatile, it might be a good idea to reduce bet sizes, and conversely, increase them when the market is relatively stable.

- Monitor and Adjust Strategies. The crypto world is extremely dynamic, so you should constantly reevaluate your betting strategies based on new information and, of course, your changing goals.

Loss Limit Shields

Loss Status

Minor losses (0-25%)

Moderate risk (25-50%)

Dangerous zone (50%+)

Stop Loss Toggle

💡 Set your threshold (e.g. 25% of deposit) and auto-exit if hit.

Bankroll Engine

Allocated Funds

Use only a fixed % (e.g. 10%) of your full bankroll.

Dynamic Sizing

Adjust bet sizes based on current bankroll value.

Strategy Monitor

Track wins/losses. Adjust only between sessions.

Lock It In

No top-ups from your main wallet mid-run.

Harnessing a Bull Market to Bet for ‘Free’

A particularly attractive bankroll strategy can enable you to bet for ‘free’ – kind of. But be warned it only works in crypto bull markets when the price of crypto is rising.

Let’s say it’s ‘Day 1’ and the price of BTC is $60,000.

- Set aside a certain amount of crypto. For example, 0.5 BTC. Let’s say it’s worth $30,000 – that value is going to be your baseline. You will use this crypto to generate your funds for gambling.

- Several days later, you check and the price of BTC has risen to $65,000. So, you’ve made $2,500 since Day 1. Convert $2,500 worth of BTC to a stablecoin like USDT to lock in the value, and transfer it to your casino account. Leave the remaining $30,000 worth of BTC in your crypto wallet.

- Use the $2,500 worth of USDT to gamble. If you make a profit, great. If you lose it all, walk away.

- Keep an eye on the BTC you set aside. When it becomes worth significantly more than $30,000 again, then convert the difference to USDT and transfer it to your casino account to gamble with. If it is worth less than $30,000 then leave it untouched.

The key to using this strategy is to only use value that is over your initial baseline for gambling purposes. The crypto you leave aside for this purpose is effectively generating your gambling bankroll for you.

Of course, this only works when the price of the crypto is rising – during bear markets, you’ll need to sit tight. And, you should only ever allocate a fraction of your available crypto for this.

Tax Implications and Legal Considerations

As with any financial activity, you should always be aware of tax and legal realities of using cryptocurrency in your specific location. The following is not financial advice and is for informational purposes only. If you are unsure of anything, you should consult local tax and legal professionals.

Tax Obligations

Cryptocurrency transactions, including those on gambling platforms, may be subject to various forms of taxation. These may include:

- Capital Gains Tax – In some jurisdictions, profits from crypto transactions, including gambling winnings, are subject to capital gains tax. This means you need to carefully record the value of your assets at the times of depositing and withdrawing to accurately calculate your tax liability.

- Reporting Requirements – Your jurisdiction may require detailed reporting of all cryptocurrency transactions. This can be a major hassle, but failure to do so may result in financial penalties or even more severe legal action.

- Tax Deductions – Now for some good news. Depending on where you live, any losses incurred during gambling may be tax deductible. If this is the case in your jurisdiction, we recommend consulting with a tax specialist for advice.

Crypto tax rules can be complicated and even if you don’t end up owing any tax, you may still be required to declare your holdings and activity.

For example, at the time of writing, in Portugal, crypto holders are required to declare their assets. Any income from the sale of crypto assets is subject to capital gains tax if the holding period is less than a year. However, if the assets have been held for over a year, any profit from their sale is tax-free.

Legal Landscape

If there’s one aspect of cryptocurrency that causes more headaches than anything else, it’s the legal and regulatory landscape.

The laws governing crypto vary massively across different countries and regions. While a few have clear laws and welcome cryptocurrency use, others have contradictory or unclear rules. And some haven’t even gotten around to considering the issue yet.

Of course, a similar legal minefield applies to online gambling as a whole. So, add the two together, and it’s a recipe for confusion.

- Jurisdictional Differences – Some countries explicitly allow cryptocurrency gambling, while others tightly regulate it, and others outright ban it. If you are gambling illegally, and you become the victim of a crime, you won’t be able to report it to the authorities without incriminating yourself in the process.

- Platform Compliance – Again, you’ll only benefit from your legal rights if you are using a crypto-gambling platform that is compliant with local regulations.

- Anonymity and Privacy – While it is true that crypto transactions are mostly pseudo-anonymous, you may still be required to verify your identification. Remember, if this happens, the gambling platform isn’t usually trying to be awkward, but rather comply with its KYC (Know Your Customer) and AML (Anti-Money Laundering) legal obligations.

Best Practices for Timing Deposits and Withdrawals

When making deposits and withdrawals at crypto gambling platforms, timing is critical. Get it right, and you can harness the markets to your advantage, but get it wrong and you may suffer significant losses.

Practical Timing Tips

Here are some useful timing tips to help you maximize the value of your crypto assets when gambling:

- Monitor Crypto Markets: Before making any crypto transaction, check the latest crypto market data. Pay attention to the specific crypto you intend to use, but also look for general market trends. For example, if prices are rising, you may want to wait a while before making a deposit, but if they are falling, it might be a good idea to withdraw.

- Beware Peak Volatility: Think twice before making deposits and withdrawals during particularly volatile times. For example, if there is some kind of major macro news event happening, like an economic or social shock.

- Make Regular Withdrawals: Avoid leaving winnings in your casino wallet in the form of volatile assets. Withdraw them regularly and convert them into more stable assets. This will shield your funds from sudden market fluctuations.

Transaction Speeds

Another aspect of cryptocurrency transactions that can be important for crypto gamblers is speed. Some blockchains, notably Ethereum and Bitcoin, can suffer from congestion and slow transaction times – sometimes taking hours. This is especially true if the market is panicked and clogged by people trying to move or convert funds. These delays can translate into significant losses.

- Choose a Fast Crypto – While BTC and ETH are the most popular cryptos, there are many faster alternatives, less prone to network congestion. For example, Litecoin, Stellar, Bitcoin Cash, Cardano, and Dogecoin.

- Platform Efficiency – While most crypto casinos and sportsbooks process deposits immediately, many can take up to 24 hours to process a withdrawal request. In the world of crypto, a lot can change in 24 hours, so look for platforms with the fastest processing times.

TIME IT RIGHT — WIN MORE, LOSE LESS

Make Routine Withdrawals

Don’t let profits sit too long — pull out regularly.

Track Market Swings

Time transactions when prices are stable — not spiking.

Use Reliable Platforms

Choose casinos with smooth processing and no delays.

Choose Speedy Coins

Prefer fast networks like Solana or Polygon to dodge bottlenecks.

Avoid Peak Volatility

Depositing or withdrawing during price surges can cost you.

Utilizing Tools

There are lots of useful cryptocurrency tools you can use to help develop and maintain a successful crypto gambling strategy. From free market tracking apps to more advanced technical analysis and portfolio management tools, here are some of our top recommendations:

| App or Tool | What it does |

|---|---|

|

|

Real-time price and trend info for thousands of digital assets. Free to use. |

|

|

Real-time price and trend info for thousands of digital assets. Free to use. |

|

|

Real-time price and trend info for thousands of digital assets. Free to use. |

|

|

Charting tools to help you identify trends. Volume footprints, candles, bars, range, Renko, and lots more. Paid, but plans start at under $15 per month, so are well worth it for most crypto gamblers. |

|

|

A complete cryptocurrency portfolio manager. Allows you to easily manage multiple crypto wallets across multiple exchanges. Free trial available. |

|

|

Formerly the stand-alone Cryptowatch, this advanced trading platform is now integrated with Kraken as Kraken Pro. |

We highly recommend downloading an app like CoinGecko and setting up price alerts to instantly notify you when relevant cryptocurrencies reach specified values. This way you can get on with things, but won’t miss those golden opportunities to maximize your crypto profits.

Hedging Strategies

Hedging is a core strategy, used by both traditional and crypto investors, to protect against potential losses by taking an opposing position in a related asset. It can also be very useful for mitigating risk in crypto gambling.

- Locking in Winnings – As a gambler, you can use hedging to lock in the value of your winnings, protecting against market fluctuations.

- Reducing Exposure – By reducing exposure to a single cryptocurrency, you can balance potential losses with gains in other assets.

Instruments for Hedging

Several different types of instruments can be used for hedging in the crypto market. Some of the main ones are:

- Futures Contracts – These allow you to agree on a future price for your cryptocurrency, effectively locking in the current value of your holdings. They can protect against falling prices but also mean you’ll lose out on gains if prices rise.

- Options – These give you the right, but don’t oblige you, to buy or sell a cryptocurrency at a pre-agreed price.

- Swaps – These are agreements to exchange cash flows between two parties, based on underlying assets, like cryptos. They are commonly used to hedge against unfavorable price movements.

4 Smart Crypto Hedging

Tactics

-

1. Lock in Winnings

Secure gains before market swings wipe them out.

-

2. Reduce Your Risk

Hedge volatile holdings to limit sudden losses.

-

3. Use Futures Contracts

Predict market moves and lock in prices ahead of time.

-

4. Explore Options & Swaps

Use smart tools to balance upside and downside risk.

Using Stablecoins

One of the easiest ways to hedge is to make use of stablecoins. These are cryptos pegged to a relatively stable asset, like the US dollar or euro. There are several reasons why stablecoins are very popular with crypto gamblers, including:

- They Preserve Value – Converting volatile cryptos into stablecoins is an easy way to preserve the value of your winnings or bankroll.

- Easy to Use – Most crypto casinos will accept popular stablecoins like USDT and USDC. You can easily convert volatile cryptos to stablecoins on any centralized or decentralized crypto exchange. Many crypto casinos also feature integrated exchange facilities, so you don’t even need to leave the site.

- Highly Liquid – Stablecoins like USDT are backed by real assets and are very liquid. This means it’s almost always possible to convert and withdraw them, without impacting the price.

Final Thoughts on Crypto Fluctuations and Gambling

The highly volatile nature of cryptocurrencies is a double-edged sword for online gamblers. On the one hand, there’s the potential for your deposits and winnings to increase in value, but rapid falls in price can result in significant losses.

Successfully mitigating risks and harnessing the upside potential of crypto requires deploying effective risk management strategies. Fundamentally, diversification should be at the heart of any crypto gambling strategy.

Loss limits and effective bankroll management are also important. When it comes to crypto gambling specifically, timing is very crucial. In such a fast-moving space, market conditions and transaction speeds should always be considered.

And, hedging strategies can be as simple as converting balances to stablecoins, or more advanced like using futures, options, and swaps.

Finally, whenever you are dealing with crypto, whether for gambling, trading, or investing, it’s important to know your tax and legal obligations. But whatever the case, you should keep detailed records of every crypto transaction.

Overall, the key message for crypto gamblers is to keep learning, stay informed, and be proactive. The volatility that scares many traditional types presents risks, but also incredible opportunities to grow your net worth.

But, as always, remember that gambling is entertainment. It is not investing and should never be considered as a way to earn money or make a living.

We hope you’ve found this guide helpful, and if you’ve got any thoughts or experiences related to the subject, please share in the comments.

Join The Conversation

No comments yet. Be the first to comment!

Continue with Apple

Continue with Apple Continue with Google

Continue with Google

Comments (0)

Share